The South African Competition Tribunal authorised EINEKEN N.V.’s offer to purchase control of Distell Group Holdings Ltd (‘Distell’) on March 9. After approvals from the Namibia Competition Commission, the Common Market for Eastern and Southern Africa, and all other relevant jurisdictions, the decision is the ultimate regulatory approval. It sets the path for the establishment of an African beverage champion at the regional level.

HEINEKEN announced its intention to purchase control of Distell and Namibia Breweries Limited (‘NBL’), which would be united with HEINEKEN South Africa (‘HSA’) to form a new HEINEKEN majority-owned business in November 2021. (Newco).

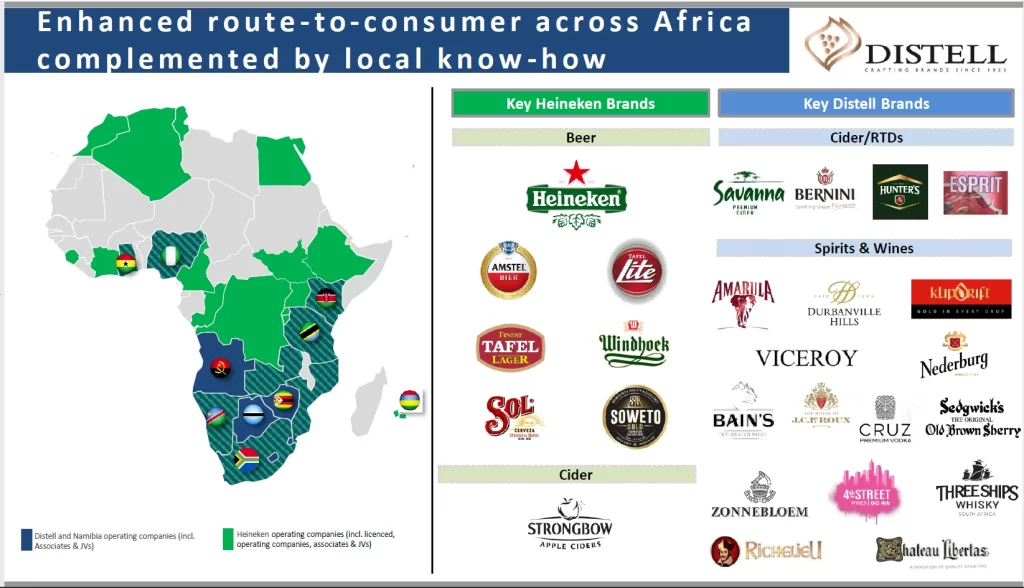

The cider, ready-to-drink beverages, spirits, and wine businesses will be combined with Heineken’s interests in Southern Africa, including Namibia, and select export markets in East Africa held by Newco, resulting in an unlisted, Southern-African focused, alcoholic beverages entity with a leading international beer and cider portfolio, combining the complementary brands, talent, and skills of Distell, Heineken, and Namibia Breweries to better serve consumers across the continent. The combined business will also have a strong footprint in neighbouring African markets.

According to Heineken, there are exciting prospects for Namibia Breweries Limited to promote premium beer and cider in Namibia and grow the legendary Windhoek brand outside its native market.

The clearance authorises an ambitious package of public-interest commitments, including continued corporate investment, broad-based black economic empowerment, job creation, localisation and supplier growth, talent development, and support to the region’s economic development.

Following steps

On the same day, a Transaction Update Announcement (TUA) describing the remaining scheme details and Distell shareholder election procedure, as well as the other key dates and times relating to the Transaction, was released. The Transaction is likely to go into effect in April.

Financial terms and projected accretion recap

HEINEKEN will spend around €2.4 billion in Newco in exchange for a 65% stake. This includes a cash payout of approximately €1.2 billion, which will be funded by bonds, existing cash resources, and committed credit facilities, as well as the contribution of its currently owned assets, which include 75% of HSA, 100% of its export businesses in certain other African markets, and a minority stake in NBL.

The Transaction is estimated to be EPS (beia) accretive this year by a low-single-digit percentage and margin accretive over the medium term, assuming significant revenue and cost savings are realised. HEINEKEN’s pro-forma net debt to EBITDA (beia) ratio is likely to rise somewhat after completion.